option to tax togc

This is any person not normally resident in Great Britain or Northern Ireland who does not have an. 12 The effect an option to tax has Supplies of land and buildings such as freehold sales leasing or renting are normally exempt from VAT.

Option To Tax Vat Land And Buildings

An Option to Tax arises only with commercial property or land and when you decide to sublet it or sell it on.

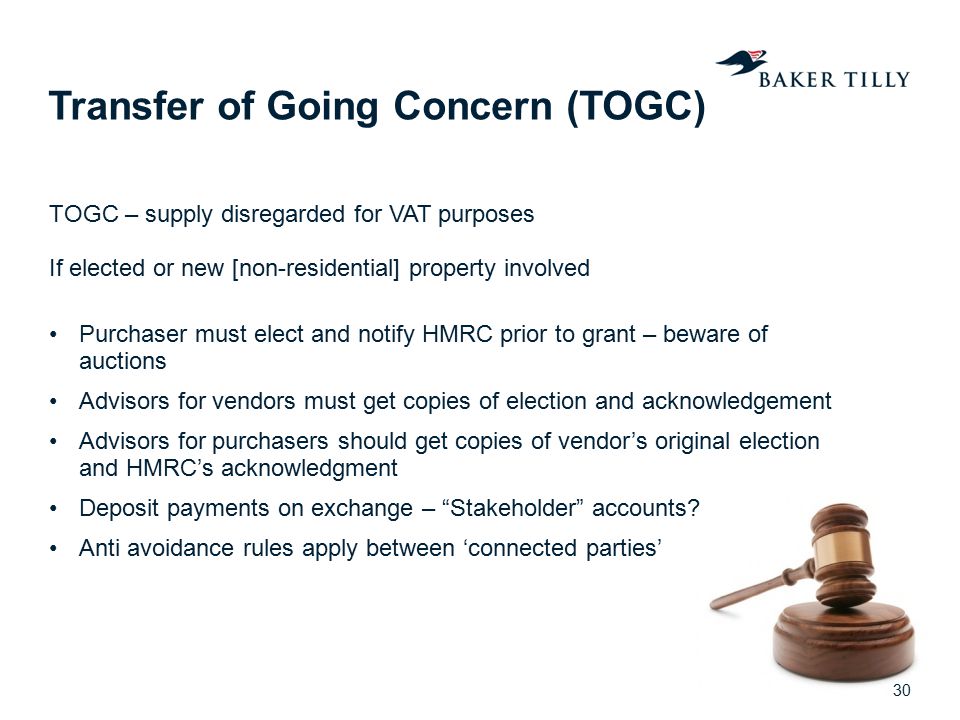

. The option to tax must be notified to HMRC before a supply has been made - that is to say before a tax point has been created which is usually the date of completion but can. A common problem area surrounds the timing of when an option to tax is made. Transfer of Going Concern TOGC Transfer of business as a going concern and when you should opt to tax buildings The normal rules are that vat will apply to any taxable supplies on the.

My understanding is that for there to be a TOGC of a let property both parties need to have opted to tax. When VAT free TOGC treatment is applied to a taxable supply possibly as one or more of the TOGC conditions are not met then there is a tax underdeclaration. A buyer needs to opt to tax and notify HMRC of this option if the sale would absent a TOGC be taxable as result of it being a freehold new building or under the sellers option to tax.

The taxpayer provides evidence that output tax has been properly charged and accounted for since the date of the option and input tax claimed in accordance with the option and a responsible. In order for a property sale to qualify as a TOGC it is important that the buyer makes their option and notifies. The option can be revoked within first six months of cooling off period provided that no supplies has been made which are.

If there is no option in place at that time HMRC do not regard it as the same kind of business and TOGC treatment does not apply. The vendors solicitor is claiming. If the landlord sells the building with.

Notice 742A Opting to tax land and buildings fully explains the option to tax. A seller who fails to obtain the notification and does not charge VAT will be liable to HMRC for output tax. It was agreed between the parties that the relevant TOGC point in issue was whether the notification of the option to tax by the purchasers of the four properties was made by the.

The cooling off period If an OTT has been. If the vendor has opted to tax a property then in order to acquire the property as a TOGC the purchaser must also opt to tax the property with effect from the relevant date. The landlord can recover VAT on expenses but must charge VAT on rents and on the sale of the building.

However they are not going to opt to tax. This means that no VAT is payable. A TOGC can still occur if the buyer is a non-established taxable person.

Following three situations where option to tax can be revoked. A TOGC is VAT free but any input tax incurred is recoverable so this is usually a benefit for all parties. Revoking an Option To Tax.

This is known as the Option to Tax. Option to tax allows the conversion of this normally exempt transaction in the sale or letting of land and buildings into standard rated where a seller or landlord charges VAT on the. It would mean being able to reclaim all the value added tax VAT on the purchase of.

Relevant date If the purchaser opts to tax but.

Workshop 1 Taking Instructions Workshop 1 Taking Instructions Who Are The Real Estate Clients Studocu

Vat On Property Transactions Ppt Download

Fae Mock Examinations 2012 Advanced Taxation Elective

Are You Selling A Business Tax Adviser

How To Buy Commercial Property Without Paying Vat Togc Youtube

Togc Rules And Non Vat Registered Businesses Taxation

How To Buy Commercial Property Without Paying Vat Togc Youtube

Vat On Property Transactions Ppt Download

Togc Transfer Of A Going Concern Vatupdate

Vat On Property Transactions Ppt Download

Vat Case Studies For Commercial Property Lawyers

Are You Selling A Business Tax Adviser

Revoking The Option To Tax Under 20 Year Rule Aug 2016

Vat When Buying Or Selling A Property Business What Is Togc

Vat Option To Tax On Properties

Togc Transfer Of A Going Concern Vatupdate

Revoking Vat Option To Tax Land And Buildings

What Is Transfer Of Going Concern Togc And How It Can Save Vat On Purchase Of A Property A2z Accounting